Innovative and sustainable finance approach to our clients’ working capital needs

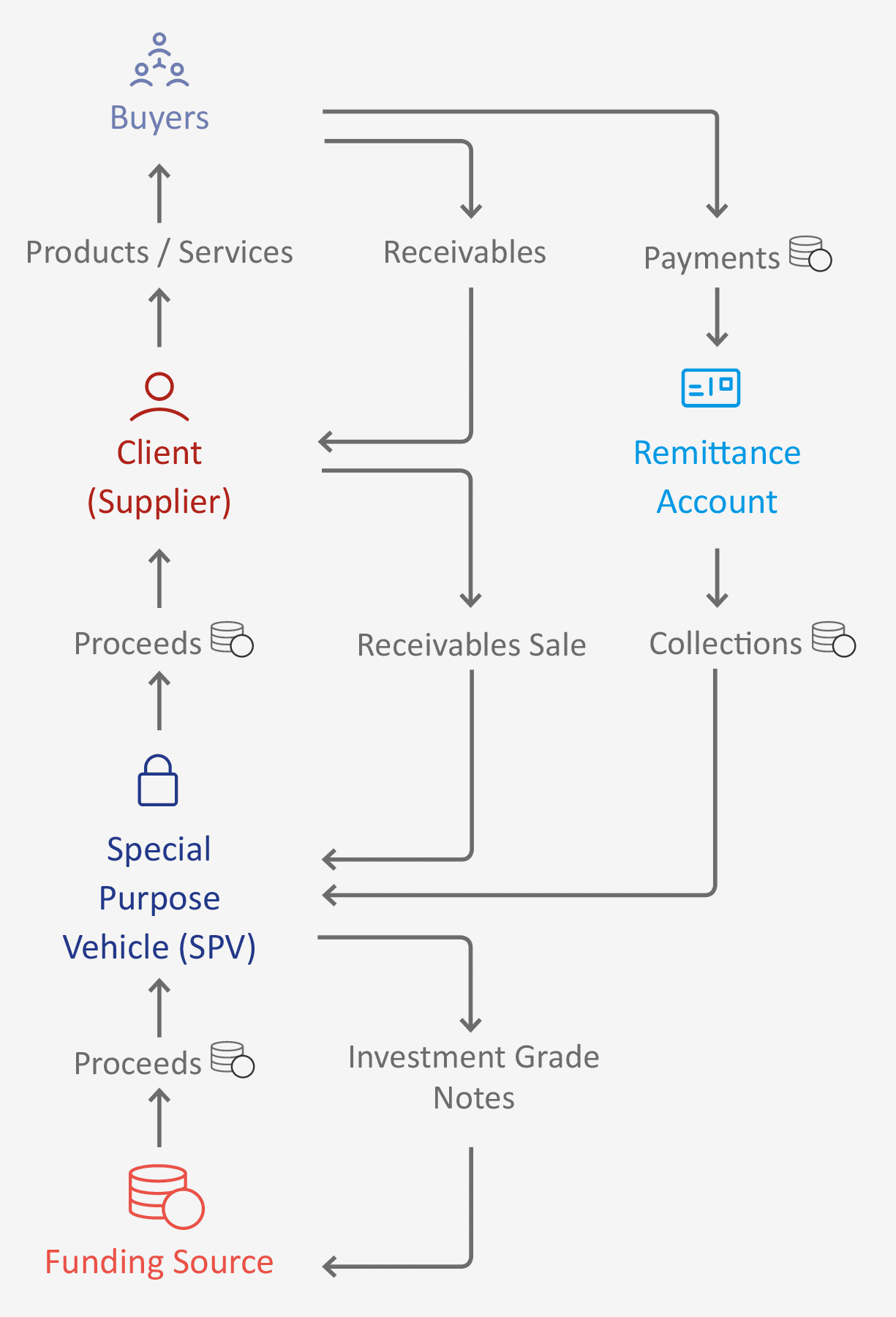

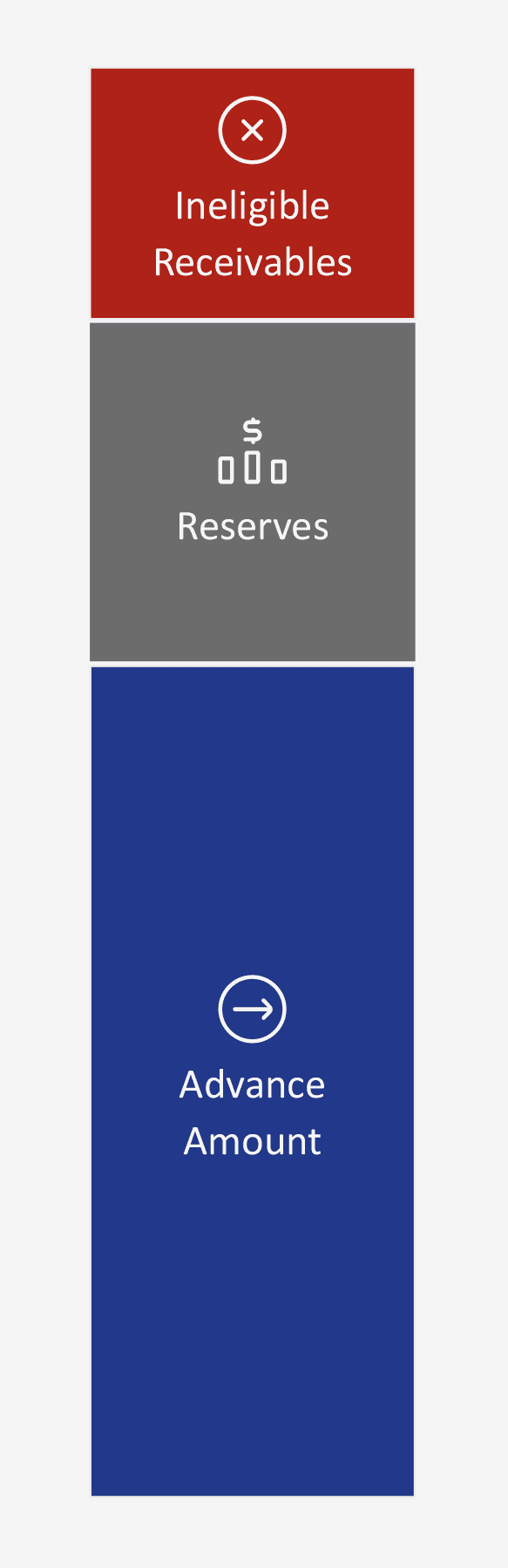

Securitisation is a mechanism for companies to raise capital against portfolios of receivables. Typically, the receivables are sold to a Special Purpose Vehicle (SPV) on a non-recourse basis. Using the receivables as collateral, the SPV is structured to issue Investment Grade notes to raise funds for the company.

Securitisation brings a range of benefits, including:

Novapproach Solutions has the expertise to:

Also, Novapproach Solutions can facilitate the structuring of mezzanine and junior notes for incremental funding and off-balance sheet treatment.

The growth in digitalisation of trade through Distributed Ledger Technology (DLT) is bringing transparency, funding source diversification, increasing liquidity, sustainability and cost efficiency to securitised finance.

This technology is delivering new concepts:

Novapproach Solutions has the expertise to assist its clients navigate and leverage this evolving technology.

A trade receivable securitisation may not always be the most efficient funding solution.

Alternative Receivables Finance is best considered when:

In such cases, Novapproach Solutions may assist in arranging other working capital solutions including:

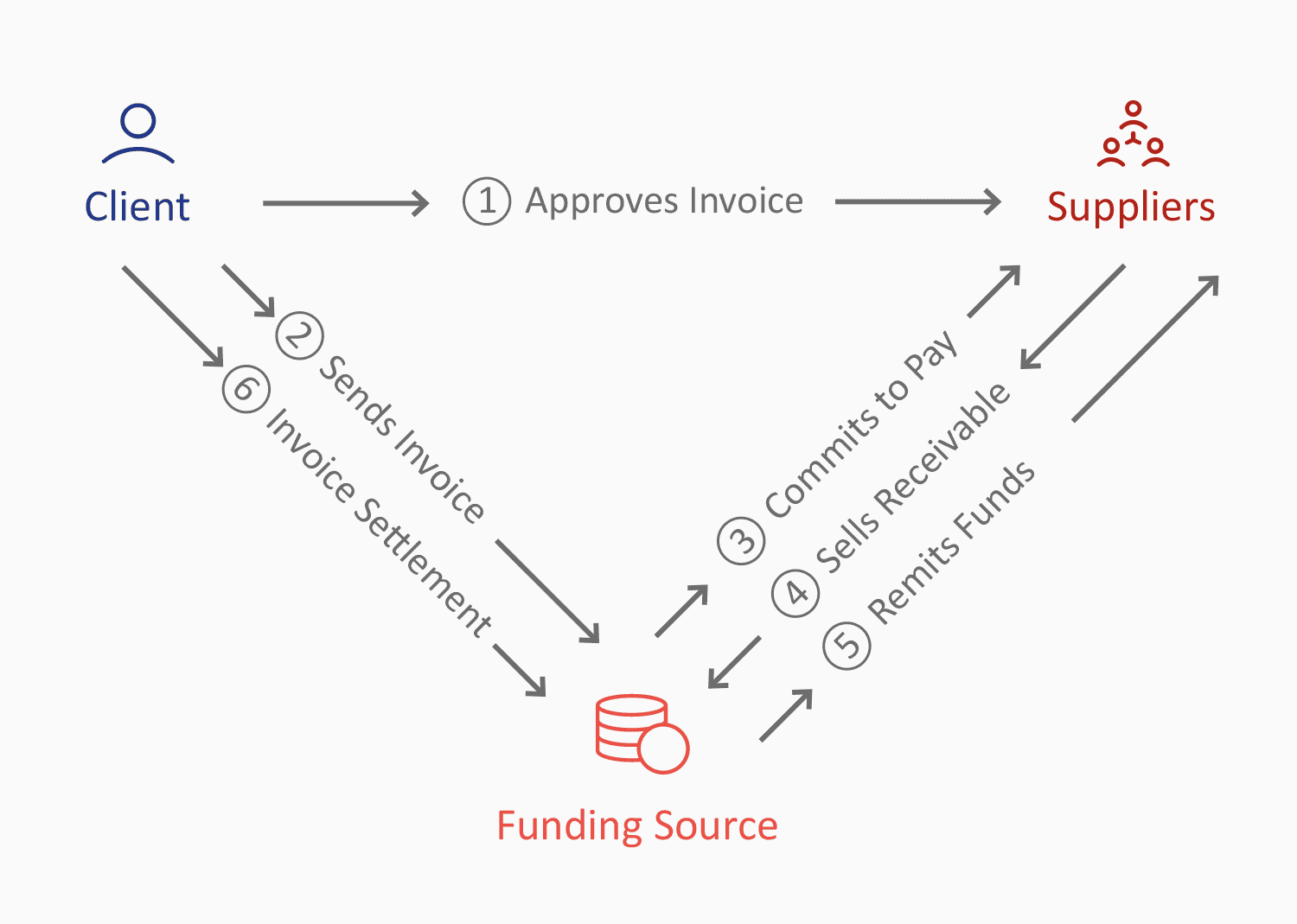

Supplier and Payables Finance is a means of using the credit strength of a Buyer to obtain cheaper finance for its weaker Suppliers.

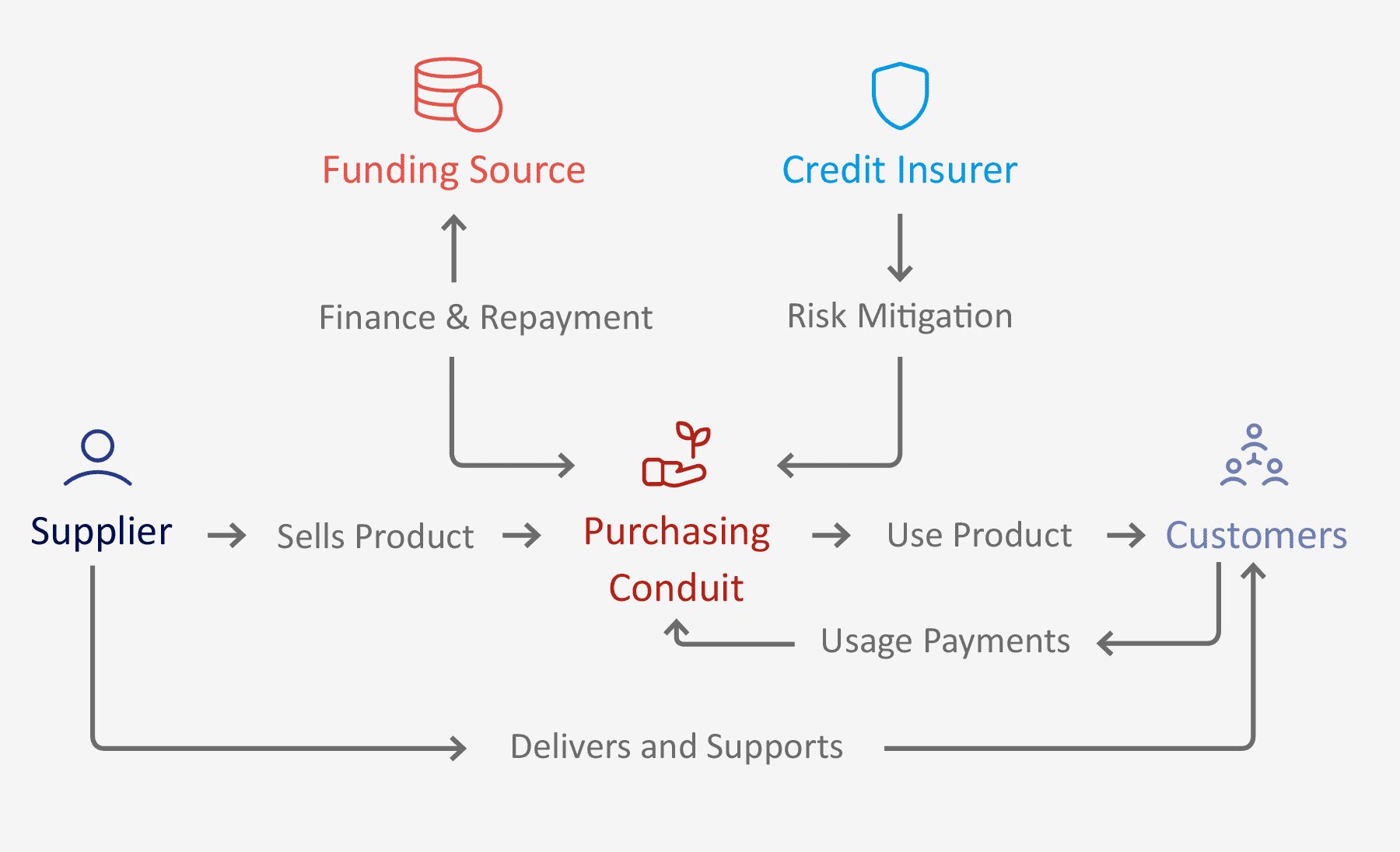

The treatment of a product as a service, for financing, brings a range of benefits.

For the Buyer

For the Supplier

For both the Buyer and Supplier

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |